Crypto Market Price Analysis Today: Bitcoin (BTC), Super Trump (STRUMP), Render (RNDR), Solana (SOL), Pepe

今日加密货币市场价格分析:比特币 (BTC)、Super Trump (STRUMP)、Render (RNDR)、Solana (SOL)、Pepe

发布: 2024/05/14 16:27 阅读: 490

Traders often prefer markets that show clear trends over those that are range-bound. In situations where the future direction is uncertain, traders may choose to wait on the sidelines, a trend currently observed with Bitcoin (BTC).

交易者通常更喜欢显示明显趋势的市场,而不是区间波动的市场。在未来方向不确定的情况下,交易者可能会选择观望,这是目前比特币(BTC)观察到的趋势。

Research from Santiment suggests that “fear and indecision” are leading to a decrease in Bitcoin’s on-chain activity, reaching near historic lows. However, the firm noted that this does not imply a further decline in Bitcoin’s value is inevitable.

Santiment 的研究表明,“恐惧和犹豫不决”正在导致比特币链上活动减少,接近历史低点。然而,该公司指出,这并不意味着比特币价值进一步下跌是不可避免的。

During this period of Bitcoin’s consolidation, some investors see an opportunity to increase their holdings. Metaplanet, a Japanese investment firm, has shifted its treasury management strategy to focus exclusively on Bitcoin, prompted by the ongoing depreciation of the Japanese yen. The firm recently added 117.7 Bitcoin to its reserves, purchased at an average price of $65,000 each.

在比特币盘整期间,一些投资者看到了增持比特币的机会。由于日元持续贬值,日本投资公司 Metaplanet 已将其资金管理策略转向专门关注比特币。该公司最近在其储备中增加了 117.7 比特币,平均价格为每枚 65,000 美元。

Typically, when a market consolidates near its all-time high, it is viewed positively because it indicates that traders are retaining their positions in anticipation of continued upward movement. However, if repeated attempts fail to breach overhead resistance, traders might liquidate their holdings, potentially triggering a significant decline.

通常情况下,当市场在历史高点附近盘整时,人们会对其持积极态度,因为这表明交易者正在保留其头寸,预计价格将持续上涨。然而,如果反复尝试未能突破上方阻力位,交易者可能会清算其持仓,从而可能引发大幅下跌。

Can the bulls maintain critical support levels in Bitcoin and various altcoins? We’ll examine the charts to determine this.

多头能否维持比特币和各种山寨币的关键支撑位?我们将检查图表来确定这一点。

Bitcoin (BTC) Price Analysis

比特币(BTC)价格分析

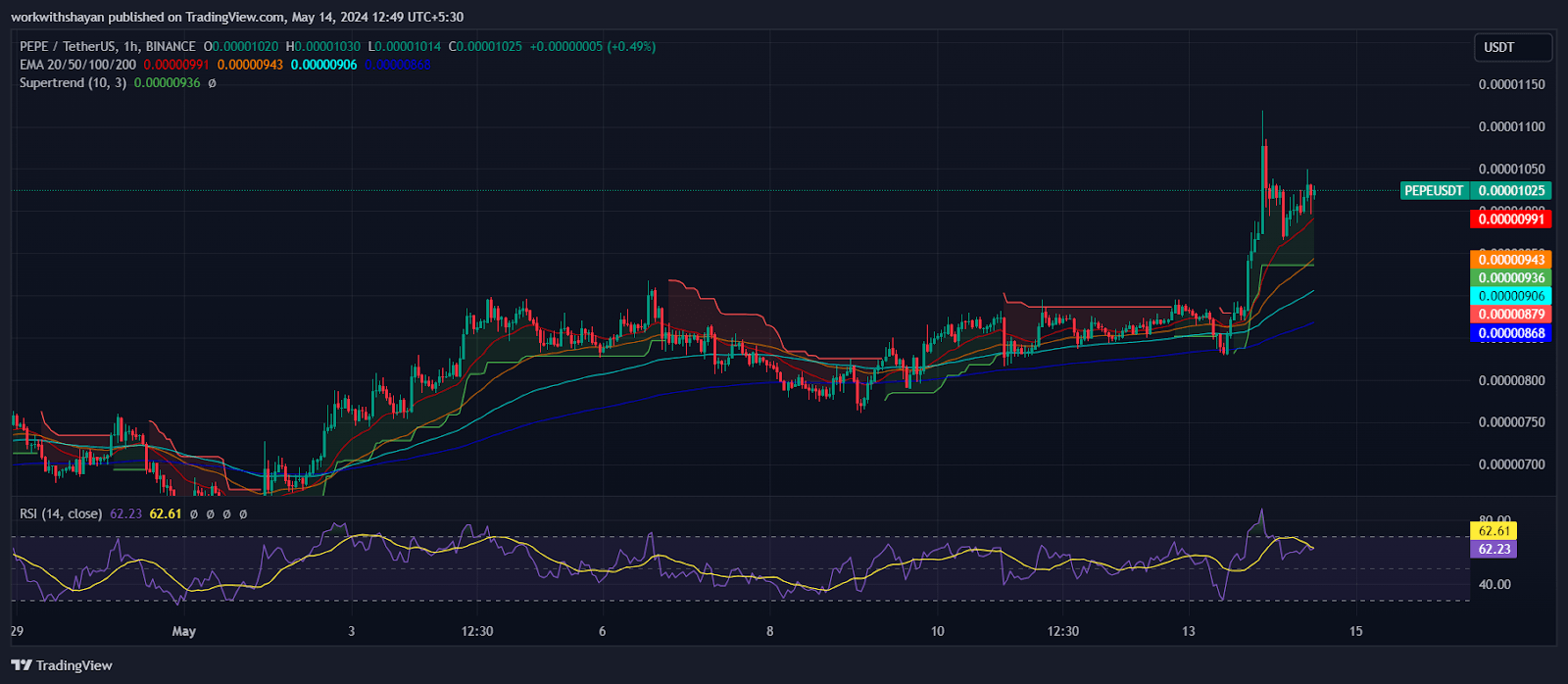

Bulls are facing challenges in keeping Bitcoin above the 20-day EMA, priced at $62,471, a sign that bears continue to apply pressure. BTC price lost its bullish momentum and is steeply declining below its immediate Fib channels.

多头面临着将比特币保持在 20 日均线上方(价格为 62,471 美元)的挑战,这表明空头继续施加压力。比特币价格失去了看涨势头,并急剧跌破其直接斐波那契通道。

BTC/USD Chart On TradingView

BTC/USD Chart On TradingView

TradingView 上的 BTC/USD 图表

The 20-day EMA appears flat and the RSI is declining toward the oversold region, hinting that Bitcoin might continue to see sideways movement for several more days. Should buyers manage to hold the price above the 20-day EMA, the BTC/USDT pair could potentially advance towards the 50-day SMA at $65,441. Although this level could present considerable resistance, overcoming it may allow the pair to escalate to $68K.

20 日均线看起来持平,RSI 正在向超卖区域下降,这暗示比特币可能会在接下来的几天里继续横盘整理。如果买家设法将价格维持在 20 日均线之上,BTC/USDT 货币对可能会升至 50 日均线 65,441 美元。尽管这一水平可能会带来相当大的阻力,但克服它可能会让该货币对升至 68,000 美元。

On the flip side, a downturn from the 50-day SMA would signal that bears are in control at higher price points. Consequently, the pair could drop towards a vital support range, spanning from $59,600 to $56,500.

另一方面,50 日移动平均线的下滑将表明空头在更高的价位上占据主导地位。因此,该货币对可能会跌向重要的支撑区间,从 59,600 美元到 56,500 美元。

Super Trump (STRUMP) Price Analysis

超级特朗普(STRUMP)价格分析

STRUMP has stayed below the 50-day Simple Moving Average (SMA) since it rejected the $0.005 level. Despite multiple breakout attempts, bears are strongly defending a surge above the immediate resistance line. As of writing, STRUMP price trades at $0.0041, surging over 7.5% in the last 24 hours.

自拒绝 0.005 美元水平以来,STRUMP 一直保持在 50 日简单移动平均线 (SMA) 下方。尽管多次尝试突破,空头仍极力捍卫突破直接阻力线的势头。截至撰写本文时,STRUMP 价格交易价格为 0.0041 美元,在过去 24 小时内飙升超过 7.5%。

STRUMP/USDT Chart On TradingView

STRUMP/USDT Chart On TradingView

TradingView 上的 STRUMP/USDT 图表

A rising bearish crossover in the moving averages, combined with the Relative Strength Index (RSI) dipping into bearish territory, indicates that sellers are currently dominant. Despite significant support at $0.0032, if this level is breached, the STRUMP/USDT pair might see a further decline to $0.003.

移动平均线的看跌交叉不断上升,加上相对强弱指数(RSI)跌入看跌区域,表明卖方目前占据主导地位。尽管 0.0032 美元有重要支撑,但如果突破该水平,STRUMP/USDT 货币对可能会进一步下跌至 0.003 美元。

Alternatively, a strong rebound from the $0.0032 support could suggest a substantial buying interest at lower levels. This scenario could keep the pair trading within a range of $0.004 to $0.005 for some time. A break above $0.005 would indicate a resurgence of bullish momentum.

或者,从 0.0032 美元支撑位强劲反弹可能表明较低水平存在大量买盘兴趣。这种情况可能会使该货币对在一段时间内保持在 0.004 美元至 0.005 美元的范围内。突破 0.005 美元将表明看涨势头复苏。

Render (RNDR) Price Analysis

渲染 (RNDR) 价格分析

The Render token faced resistance at the $11.5 level, triggering short-term traders to cash out. This selling pressure led the price below the 23.6% Fib level and is aiming for a retest of the immediate support line. As of writing, RNDR price trades at $10.9, surging over 4.2% in the last 24 hours.

Render 代币在 11.5 美元水平面临阻力,引发短期交易者套现。这种抛售压力导致价格跌破 23.6% 斐波那契水平,目标是重新测试直接支撑线。截至撰写本文时,RNDR 价格交易价格为 10.9 美元,在过去 24 小时内飙升超过 4.2%。

RNDR/USD Chart On TradingView

RNDR/USD Chart On TradingView

TradingView 上的 RNDR/USD 图表

For the uptrend to continue, it is crucial for buyers to staunchly defend the ascending support line. Maintaining this level could push the RNDR/USDT pair back towards the $12 mark and possibly higher to the 61.8% Fibonacci retracement level. A sustained move above this level would signal the start of a new bullish phase.

为了继续上涨趋势,买家必须坚定捍卫上升支撑线。维持这一水平可能会将 RNDR/USDT 货币对推回到 12 美元大关,并可能更高至 61.8% 斐波那契回撤水平。持续突破该水平将标志着新的看涨阶段的开始。

On the flip side, if the price falls below the ascending support line, it would indicate a weakening of the bullish trend. Such a scenario could result in the pair stabilizing in a trading range between $9.4 and $8.3, suggesting a phase of consolidation.

另一方面,如果价格跌破上升支撑线,则表明看涨趋势减弱。这种情况可能导致该货币对稳定在 9.4 美元至 8.3 美元之间的交易区间,这表明进入了盘整阶段。

Solana (SOL) Price Analysis

Solana (SOL) 价格分析

Solana price has surged and is currently aiming for a clear uptrend above the $149 level, aiming to meet buyers’ demand. However, bears are attempting to retest buyers’ patience now.

Solana 价格飙升,目前目标是明确上涨至 149 美元以上,以满足买家的需求。然而,空头现在正试图重新测试买家的耐心。

SOL/USD Chart On TradingView

SOL/USD Chart On TradingView

TradingView 上的 SOL/USD 图表

The flat 20-day EMA (at $146) and the RSI hovering around the midpoint offer no distinct advantage to either the bulls or the bears. Should the price hold above the 20-day EMA, it would indicate strong buying at lower levels, potentially pushing the pair towards the tough resistance at $162.

持平的 20 日均线(146 美元)和徘徊在中点附近的 RSI 对多头或空头都没有提供明显的优势。如果价格维持在 20 日均线上方,则表明较低水平上存在强劲买盘,可能推动该货币对走向 162 美元的强阻力位。

Conversely, if the price falls from the 20-day EMA and drops below $137, it would suggest that the bears are gaining momentum. In this scenario, the SOL/USDT pair might decline to $126, where it is likely that bulls will begin to engage.

相反,如果价格从 20 日均线跌破 137 美元,则表明空头势头正在增强。在这种情况下,SOL/USDT 货币对可能会跌至 126 美元,多头可能会开始介入。

Pepe Price Analysis

佩佩价格分析

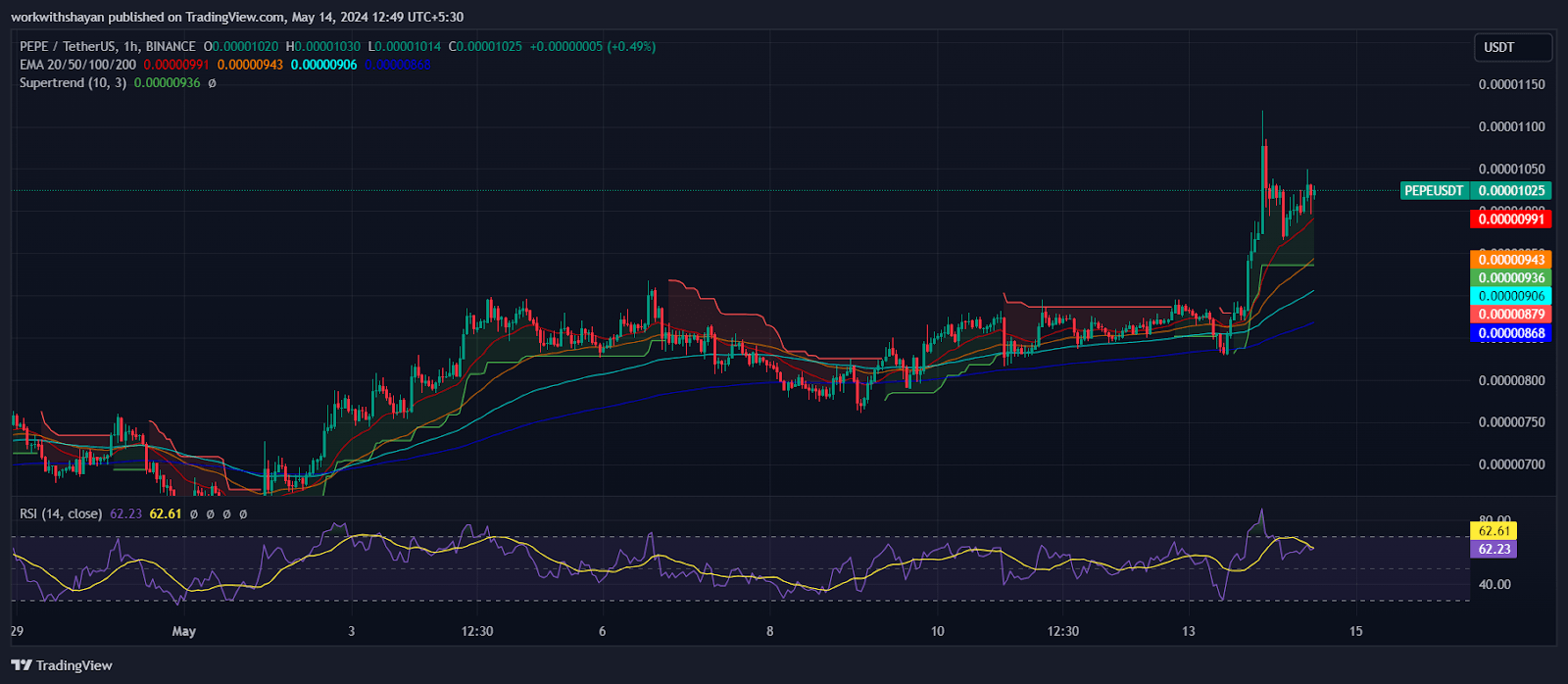

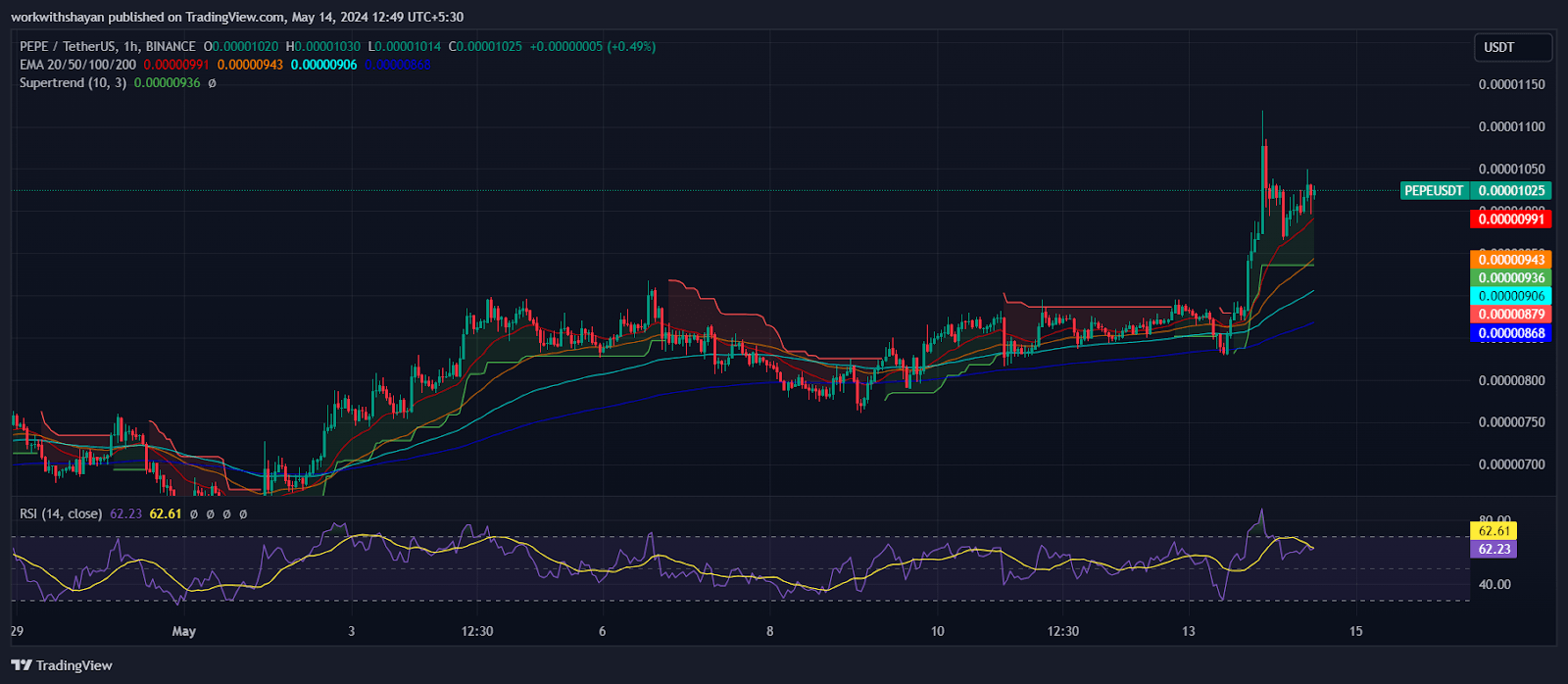

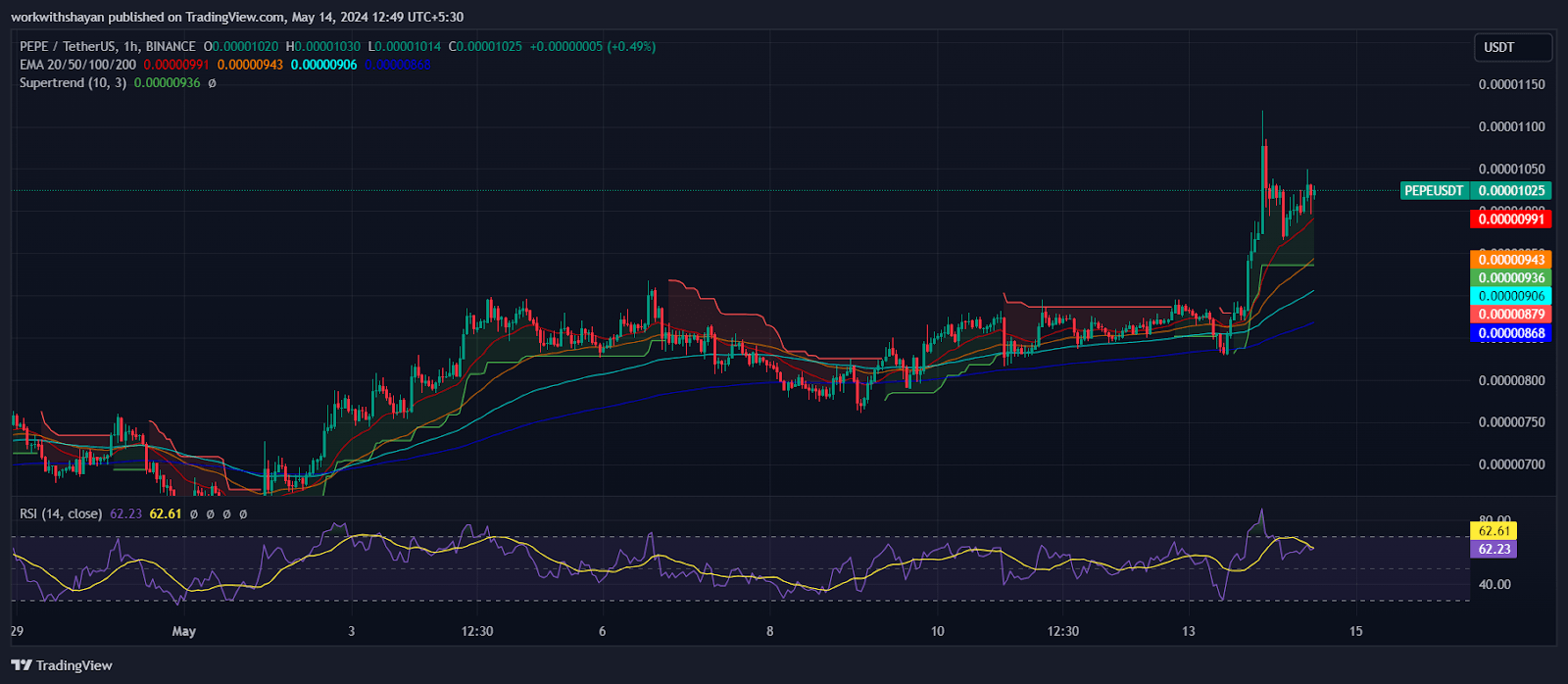

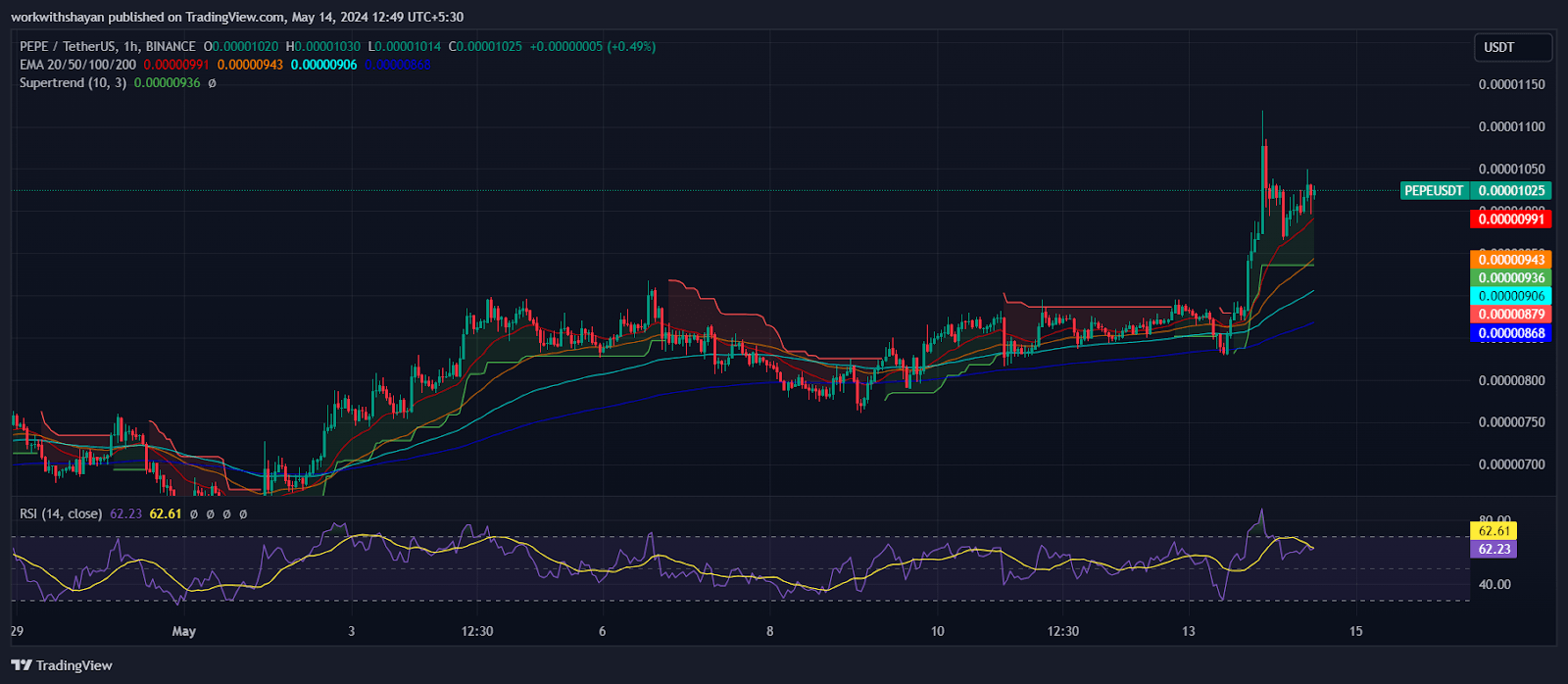

Pepe price has been skyrocketing in the last few days and might soon break buyers’ patience. However, bears remain strong around the $0.000011 level. Currently, Pepe price trades at $0.00001024, surging over 20% in the last 24 hours.

过去几天佩佩的价格一直在飙升,可能很快就会打破买家的耐心。然而,空头在 0.000011 美元附近依然强劲。目前,Pepe 价格为 0.00001024 美元,在过去 24 小时内飙升超过 20%。

PEPE/USD Chart On TradingView

PEPE/USD Chart On TradingView

TradingView 上的 PEPE/USD 图表

Buyers are attempting to keep the price above the 20-day Exponential Moving Average (EMA) of $0.0000091. Should they manage this, the PEPE/USDT pair could climb towards the 50-day Simple Moving Average (SMA). This threshold is crucial for the bears to defend, as surpassing it could trigger a surge towards the upper resistance zone ranging from $0.000015 to $0.00002.

买家试图将价格保持在 20 天指数移动平均线 (EMA) 0.0000091 美元之上。如果他们能够做到这一点,PEPE/USDT 货币对可能会攀升至 50 日简单移动平均线 (SMA)。这个阈值对于空头的防御至关重要,因为超过它可能会引发价格飙升至 0.000015 美元至 0.00002 美元的上方阻力区。

Conversely, if the price falls and settles below $0.000009, it would confirm a bearish pattern. Following this, the pair could potentially drop to the strong support level at $0.0000083.

相反,如果价格下跌并稳定在 0.000009 美元以下,则将确认看跌模式。此后,该货币对可能会跌至 0.0000083 美元的强支撑位。

近期新闻

更多>- 同性恋 Pepe Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- BTFD 预售吸引了最佳新 Meme 代币预售的投资者,PEPE 和 SPX6900 主导了市场,带来了可观的回报... 01-01

- 同性恋 Pepe (HOMOPEPE) Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- 指标表明 WIF、JASMY 和 PEPE 在 2025 年具有巨大潜力 01-01

- 在 Pepe 和 Moo Deng 的加密炒作中,BTFD 币的预售不容错过:本周将加入最佳 Meme 币预售 01-01

- 同性恋 Pepe (HOMOPEPE) Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- 下一季度的加密宝石:最值得关注的 5 个代币 01-01

- 为什么 $PEPE 今天上涨 20%,下一个可能是哪种代币 01-01

- 短期最佳新 Meme 代币:BTFD 在预售中筹集了 470 万美元,BONK 拥有低成本交易,PEPE 拥有稳定的追随者... 01-01

精选专题

更多>>-

- pepecoin 价格分析

- 本主题提供与 PepeCoin 价格相关的文章,涵盖 PepeCoin 的关键见解和分析

-

- 佩佩:模因明星

- 本主题提供与最有前途的模因 PEPECOIN 相关的文章,该项目有潜力成为主流数字货币。具有去中心化、可靠、易用、速度快、成本低、可扩展等优点,预计未来会得到更广泛的应用

-

- Pepecoin 价格预测

- 我们收集了有关 pepecoin 成功故事的事实,并提供了 pepecoin 价格预测

精选文章

更多>>- 1 Avalanche 和 Aptos 竞争对手在两周内筹集了超过 60 万美元

- 2 今日加密货币价格:随着 BTC、Pepe Coin、SEI 的上涨,市场继续上涨

- 3 主要加密货币分析师托尼看好这些模因币,但其中有一个脱颖而出

- 4 MTAUR 准备好粉碎 DOGE 和 PEPE:即将到来 100 倍的价格增长吗?

- 5 Memecoins 在 2024 年激增,Popcat 年初至今涨幅达 7,621%,领先于顶级加密代币

- 6 PEPE Meme 币重创 ATH——看看去年投资 83 美元的 Pepe 币现在值多少钱

- 7 错过了《被解放的佩佩》吗?别担心,这款新的 Pepe 主题 Meme 代币将在 2025 年带来更大收益

- 8 前 4 名山寨币 70% 折扣 – 最后机会!

- 9 聪明的 $Pepe 交易员在市场下跌期间获利 1170 万美元

- 10 狗狗币创造者向 NBA 传奇人物斯科蒂·皮蓬提议 DOGE