XRP, SOL, and DOGE open interest falls combined 51% in the last month

XRP、SOL 和 DOGE 未平仓合约上个月合计下降 51%

发布: 2024/05/01 14:29 阅读: 311

The open interest (OI) of major cryptocurrencies including XRP (XRP), Solana (SOL), and Dogecoin (DOGE) have been wiped a combined 51% in the last month.

上个月,包括 XRP (XRP)、Solana (SOL) 和 Dogecoin (DOGE) 在内的主要加密货币的未平仓合约 (OI) 总计减少了 51%。

“Market participants are becoming disinterested, which is reflected in the drop in open interest,” crypto trader TheCryptoMann wrote in an April 30 post on X.

加密货币交易商 TheCryptoMann 在 4 月 30 日的 X 帖子中写道:“市场参与者变得不感兴趣,这反映在未平仓合约的下降上。”

OI is a measure of the total value of all outstanding or unsettled crypto futures contracts across exchanges. It is a key metric traders and analysts use to assess market sentiment and anticipate future price movements.

OI 是衡量交易所内所有未结算或未结算的加密货币期货合约总价值的指标。它是交易者和分析师用来评估市场情绪和预测未来价格走势的关键指标。

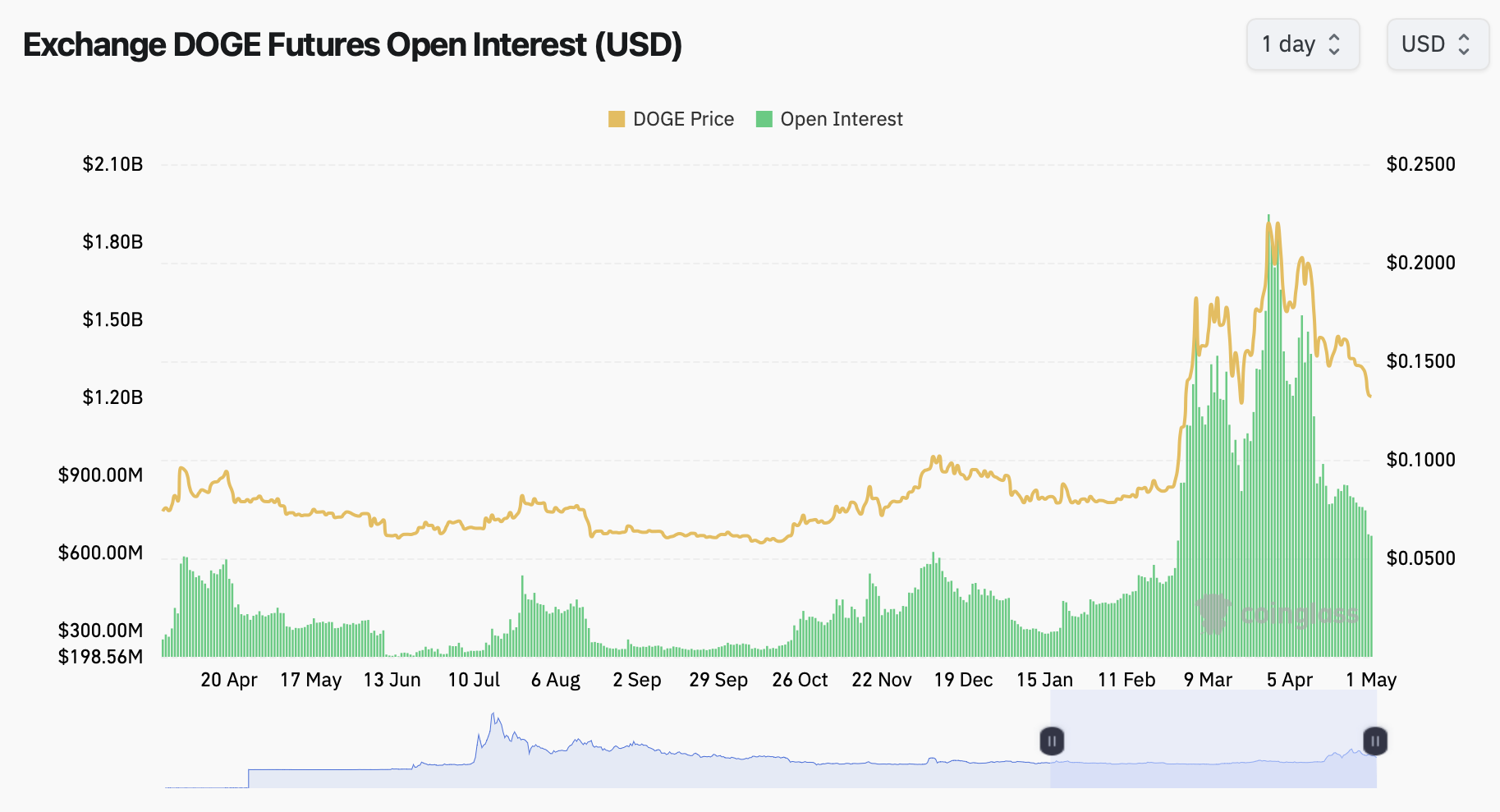

Dogecoin experienced the largest decline in OI among the nine largest cryptocurrencies by market capitalization, falling 64% to $668.2 million since April 1, per CoinGlass data.

根据 CoinGlass 的数据,狗狗币的 OI 跌幅是按市值计算的九大加密货币中最大的,自 4 月 1 日以来下跌 64% 至 6.682 亿美元。

Solana's open interest is currently at $1.51 billion, which represents a 47% decrease since April 1.

Solana 目前的未平仓合约为 15.1 亿美元,自 4 月 1 日以来减少了 47%。

Meanwhile, XRP's OI stands at $497.67 million, marking a 44% decrease within the same time frame.

与此同时,XRP 的 OI 为 4.9767 亿美元,同期下降了 44%。

Open Interest of Dogecoin has declined 64% over the past month. Source: CoinGlass

狗狗币的未平仓合约在过去一个月下降了 64%。来源:CoinGlass

Market instability often contributes to declining OI, as traders become unsure about the market's direction and are less willing to take bets on either side of the price action.

市场不稳定往往会导致持仓量下降,因为交易者对市场方向变得不确定,并且不太愿意在价格走势的任何一方进行押注。

“Open interest close to all-time lows since FTX nuke,” crypto trader TheoTrader wrote in an April 26 post on X, noting that the current OI levels are similar to those seen around the November 2022 collapse of the now-defunct crypto exchange FTX.

加密货币交易商 TheoTrader 在 X 上 4 月 26 日的帖子中写道:“未平仓合约接近 FTX 核武器以来的历史低点”,并指出当前的 OI 水平与 2022 年 11 月现已解散的加密货币交易所 FTX 崩溃前后的水平相似。

The aftermath of the April 20 Bitcoin halving — which has seen Bitcoin miner revenue fall to new yearly lows — is another major catalyst of market uncertainty in the current conditions.

4 月 20 日比特币减半导致比特币矿商收入跌至年度新低,这是当前情况下市场不确定性的另一个主要催化剂。

There are expectations of a further market correction, but it's unclear how severe it might be, causing fewer traders to take new positions.

人们预计市场将进一步调整,但目前尚不清楚调整的严重程度,从而导致更少的交易者建立新的头寸。

Related: Bitcoin sub-$60K levels in focus after daily crypto liquidations near $300M

相关:每日加密货币清算量接近 3 亿美元后,比特币低于 6 万美元的水平成为焦点

The two leading cryptocurrencies by market capitalization have also experienced a drop in OI coinciding with price declines across the wider market.

按市值计算,两种领先的加密货币的 OI 也出现了下降,同时整个市场的价格也出现了下跌。

Bitcoin's (BTC) open interest has decreased by 21% to $25.58 billion, while its price has fallen 14.87% to $60,149 at the time of publication, per CoinMarketCap data.

根据 CoinMarketCap 的数据,截至发布时,比特币 (BTC) 的未平仓合约已下降 21% 至 255.8 亿美元,而其价格已下跌 14.87% 至 60,149 美元。

Similarly, Ether (ETH) has seen a 22% drop in open interest to $10.02 billion, with its price declining by 16.67% and currently trading slightly above the key support level at $3,005.

同样,以太坊(ETH)的未平仓合约下降了 22%,至 100.2 亿美元,价格下跌了 16.67%,目前交易价格略高于 3,005 美元的关键支撑位。

Over the past 30 days, more capital has moved away from altcoins and into Bitcoin. As a result, Bitcoin dominance — BTC’s relative share of the total crypto market cap — has increased by 2.13%, reaching 54.77%, according to TradingView data.

在过去的 30 天里,更多的资金从山寨币转移到了比特币。根据 TradingView 的数据,比特币的主导地位——比特币在加密货币总市值中的相对份额——增加了 2.13%,达到 54.77%。

Magazine: 7 ICO alternatives for blockchain fundraising: Crypto airdrops, IDOs & more

杂志:区块链筹款的 7 种 ICO 替代方案:加密货币空投、IDO 等

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

本文不包含投资建议或建议。每一项投资和交易行为都涉及风险,读者在做出决定时应自行研究。

近期新闻

更多>- 同性恋 Pepe Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- BTFD 预售吸引了最佳新 Meme 代币预售的投资者,PEPE 和 SPX6900 主导了市场,带来了可观的回报... 01-01

- 同性恋 Pepe (HOMOPEPE) Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- 指标表明 WIF、JASMY 和 PEPE 在 2025 年具有巨大潜力 01-01

- 在 Pepe 和 Moo Deng 的加密炒作中,BTFD 币的预售不容错过:本周将加入最佳 Meme 币预售 01-01

- 同性恋 Pepe (HOMOPEPE) Solana Memecoin 在交易所上市前上涨 18,000%,而 SHIB、BONK 和 DOGE 崩盘 01-01

- 下一季度的加密宝石:最值得关注的 5 个代币 01-01

- 为什么 $PEPE 今天上涨 20%,下一个可能是哪种代币 01-01

- 短期最佳新 Meme 代币:BTFD 在预售中筹集了 470 万美元,BONK 拥有低成本交易,PEPE 拥有稳定的追随者... 01-01

精选专题

更多>>-

- pepecoin 价格分析

- 本主题提供与 PepeCoin 价格相关的文章,涵盖 PepeCoin 的关键见解和分析

-

- 佩佩:模因明星

- 本主题提供与最有前途的模因 PEPECOIN 相关的文章,该项目有潜力成为主流数字货币。具有去中心化、可靠、易用、速度快、成本低、可扩展等优点,预计未来会得到更广泛的应用

-

- Pepecoin 价格预测

- 我们收集了有关 pepecoin 成功故事的事实,并提供了 pepecoin 价格预测

精选文章

更多>>- 1 Avalanche 和 Aptos 竞争对手在两周内筹集了超过 60 万美元

- 2 今日加密货币价格:随着 BTC、Pepe Coin、SEI 的上涨,市场继续上涨

- 3 主要加密货币分析师托尼看好这些模因币,但其中有一个脱颖而出

- 4 MTAUR 准备好粉碎 DOGE 和 PEPE:即将到来 100 倍的价格增长吗?

- 5 Memecoins 在 2024 年激增,Popcat 年初至今涨幅达 7,621%,领先于顶级加密代币

- 6 PEPE Meme 币重创 ATH——看看去年投资 83 美元的 Pepe 币现在值多少钱

- 7 错过了《被解放的佩佩》吗?别担心,这款新的 Pepe 主题 Meme 代币将在 2025 年带来更大收益

- 8 前 4 名山寨币 70% 折扣 – 最后机会!

- 9 聪明的 $Pepe 交易员在市场下跌期间获利 1170 万美元

- 10 狗狗币创造者向 NBA 传奇人物斯科蒂·皮蓬提议 DOGE